Any business or charity needs money to operate. I recently wrote about how to do a back-of-the-envelope calculation to determine the financial feasibility of your business. In this article we look at your non-profit project or organization. We will focus on the question:

We will start by considering the sources of money coming into your charity. Then we consider the expenses to be incurred. Finally, we will compare the two so you can estimate the answer to the question above.

Sources of Income

The sources of income for your charity will vary tremendously depending on the nature of your operations. Here are some to consider:

The sources of income for your charity will vary tremendously depending on the nature of your operations. Here are some to consider:

- Program/Participation fees – Income from people receiving services, such as entry fees, class registration fees, membership, or materials fees.

- Charitable Grants – Money received from other charities or foundations to support your work.

- Government Grants – Money received from local, regional, state, or Federal agencies.

- Event Income – Fundraising event revenue. Don’t forget the cost of putting on the event.

- Individual Donors – Small or large gifts raised from individuals, either through direct solicitation, mail campaigns, or online. Consider legacy gifts for the long term.

- Other Operation Revenue – Includes other sources of income, such as renting out your facilities or sales of product (ex. Gift store).

- Income produced by endowments or other long term funding.

Each revenue stream requires it own distinct effort, and the payoff will vary. Consider the amount of money raised versus the effort involved. Some sources may be recurring once established and some may be one-time raises.

It is best to strategically decide what sources to pursue rather than taking a shotgun approach. Putting a token effort into lots of different things hoping one will succeed does not replace a thoughtful approach and plan to fund raising. It is good to keep an open mind and try different approaches from time to time, in order to find the best fit for your organization.

Expenses

There are many possible expenses for your organization. Try to come up with a ballpark estimate for each one. Here are some ideas to get you started:

There are many possible expenses for your organization. Try to come up with a ballpark estimate for each one. Here are some ideas to get you started:

- Services – What services do you offer? How often? What is the cost per event, service, or time period? Is there also an Outreach cost?

- Staffing – How many people, how much does each work (full-time/part-time), what are typical pay scales? Don’t forget benefits, taxes, etc.

- Location – Rent, Buy, Build, be Virtual? How many square feet for staff and services? How much per square foot? How much does it cost to maintain it as well?

- Hardware/Equpment – Items needed to run your programs or support your organization.

- Materials/Supplies – What do you need to run your charity or program?

- Fundraising – Consider staffing, mailings, web site, social media, grant writing, etc.

- Other Items – Food, Travel, Insurance.

Are you an organization that can start small and grow, or do you have significant startup costs before you can launch?

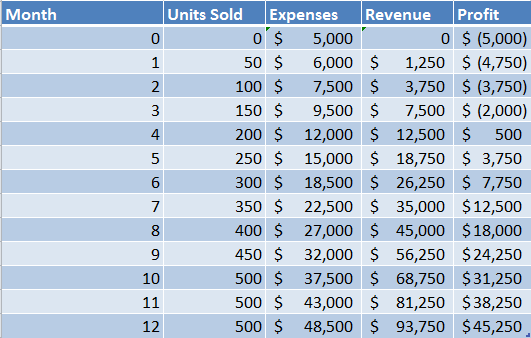

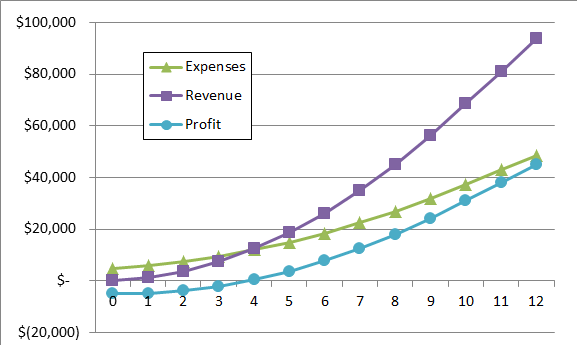

Create a basic timeline for the roll out and first years of your organization. Choose a unit of size appropriate for your organization (# events, staff size, # clients, etc). How big can you reasonably expect to be the first month, the first quarter, the first year, and after three years?

Estimate how each expense scales with size. Then combine your size estimate and expense scaling to map out your start up expenses and your annual expenses for the first few years.

Putting It All Together

If your start up expenses are large (building something, setting up an infrastructure, etc), you will need to have a capital campaign. This is really hard for a new organization without a track record. See if you can start small and grow into this once you have base operations established. Otherwise, get some experience on your team and build a compelling story.

The natural operating cycle duration for most charities is the annual basis. Let’s focus on your initial operations budget framework.

Your program fees and some operations revenue typically scale with your expenses and size of operations. Calculate those right away and look at the gap. Your annual fundraising need can be determined using your size estimates and your expense scaling.

Evaluate your income sources and pick two or three that seem the most promising to close the gap. Does it seem reasonable to raise that much money from those sources? Based on your own fundraising experience, similar organizations, or research you have performed you should be able to evaluate the feasibility of your project. Try some market research – talk to potential donors, grant organizations, etc to see if they have the level of interest needed to support your goals.

If it doesn’t seem promising, can you alter the model or rollout to be more achievable? Once the numbers work you are ready to put together a full budget and go for it.

Good luck!

You have a great start-up idea. The market is interested. The technical barriers have been passed. You are serious about making it a business. Before you pull the trigger, the questions is “will it fly?”

You have a great start-up idea. The market is interested. The technical barriers have been passed. You are serious about making it a business. Before you pull the trigger, the questions is “will it fly?” Fundamentally, to answer these questions you need two types of information:

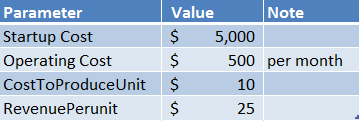

Fundamentally, to answer these questions you need two types of information: Start with a blank piece of paper or empty document. First, I want you to brainstorm all the different types of things you will need to spend money on. Some will be obvious so add those right away to your paper.

Start with a blank piece of paper or empty document. First, I want you to brainstorm all the different types of things you will need to spend money on. Some will be obvious so add those right away to your paper.

A Quick Pitch is similar to an Elevator Pitch, in that you are trying to deliver an actionable message to your listener in a short amount of time. However, a Quick Pitch takes place within more defined context, such as a competition, and is specifically done in front of an audience.

A Quick Pitch is similar to an Elevator Pitch, in that you are trying to deliver an actionable message to your listener in a short amount of time. However, a Quick Pitch takes place within more defined context, such as a competition, and is specifically done in front of an audience. We all love to hear personal stories. It may be your personal story, the personal story of a client, or even the imagined story of a future client. You can use the story to highlight how important the problem is, how innovative your solution is, or how much better life is for the subject with your solution. The best story is one in which each audience member can personally feel as if they or somebody they know are the main character of the story. If they come away from the story imagining themselves using your product, then they will remember your product and might even be your next customers. Engage your audience on an emotional level, rather than just on an intellectual level.

We all love to hear personal stories. It may be your personal story, the personal story of a client, or even the imagined story of a future client. You can use the story to highlight how important the problem is, how innovative your solution is, or how much better life is for the subject with your solution. The best story is one in which each audience member can personally feel as if they or somebody they know are the main character of the story. If they come away from the story imagining themselves using your product, then they will remember your product and might even be your next customers. Engage your audience on an emotional level, rather than just on an intellectual level. So how do you make best use of that precious one minute? There are no firm rules for timing, but the outline below is a good framework with which to start:

So how do you make best use of that precious one minute? There are no firm rules for timing, but the outline below is a good framework with which to start: We are excited to be hosting the first-ever

We are excited to be hosting the first-ever

While the media likes to tell the story of the “inspired” lone entrepreneur who had a great idea that magically changed the world or caused a huge new company to sprout from nothing this is the rare exception and you are often not hearing the full story. Real innovation takes work. You need to be open to opportunities, look for them in the right places, and exploit them when they arrive.

While the media likes to tell the story of the “inspired” lone entrepreneur who had a great idea that magically changed the world or caused a huge new company to sprout from nothing this is the rare exception and you are often not hearing the full story. Real innovation takes work. You need to be open to opportunities, look for them in the right places, and exploit them when they arrive. A great opportunity, especially for existing companies that have fielded products, is the unexpected success. Often companies focus on what is failing and put all of their energy into those problems, but they neglect what is succeeding better than expected. If a particular product or service is succeeding better than expected then it is important to explore what opportunity that might be revealing.

A great opportunity, especially for existing companies that have fielded products, is the unexpected success. Often companies focus on what is failing and put all of their energy into those problems, but they neglect what is succeeding better than expected. If a particular product or service is succeeding better than expected then it is important to explore what opportunity that might be revealing. A misalignment is when the expectations and assumptions about the world or a market do not match up to the reality of that world or market. An example of this is the “bubble”. In this case, the assumption is a very high expectation mixed with a low reality resulting in over-valuation. The opportunity is to bet against the bubble.

A misalignment is when the expectations and assumptions about the world or a market do not match up to the reality of that world or market. An example of this is the “bubble”. In this case, the assumption is a very high expectation mixed with a low reality resulting in over-valuation. The opportunity is to bet against the bubble. Cross pollination is moving a technology or a concept from one area into a completely different area, or mixing two disparate fields that have not been combined before. An example of this is Barack Obama’s success in using technology, social media, and big data analysis in politics for his successful 2008 presidential bid. GMO food is another example of two separate disciplines – genetics and food production – being combined.

Cross pollination is moving a technology or a concept from one area into a completely different area, or mixing two disparate fields that have not been combined before. An example of this is Barack Obama’s success in using technology, social media, and big data analysis in politics for his successful 2008 presidential bid. GMO food is another example of two separate disciplines – genetics and food production – being combined. An area which is often neglected by entrepreneurs is the area of demographics, which is unfortunate since this area leads to some very predictable opportunities. What opportunities do the Baby Boomers present? How about the Millennials? Predicting what these groups will need at each stage of their lives is not rocket science. And there are plenty of opportunities here to exploit.

An area which is often neglected by entrepreneurs is the area of demographics, which is unfortunate since this area leads to some very predictable opportunities. What opportunities do the Baby Boomers present? How about the Millennials? Predicting what these groups will need at each stage of their lives is not rocket science. And there are plenty of opportunities here to exploit. Opportunity is all around you. Keep track of the ideas you come up with or those that you find in magazines or newspapers, or talking to clients, vendors, or friends. Once you have a list of innovation opportunities, you can evaluate which one is the best fit for you and your skill set, and that you are able to exploit. More next time on how to make use of your innovation ideas.

Opportunity is all around you. Keep track of the ideas you come up with or those that you find in magazines or newspapers, or talking to clients, vendors, or friends. Once you have a list of innovation opportunities, you can evaluate which one is the best fit for you and your skill set, and that you are able to exploit. More next time on how to make use of your innovation ideas.

Leon Presser’s book

Leon Presser’s book